Table of Content

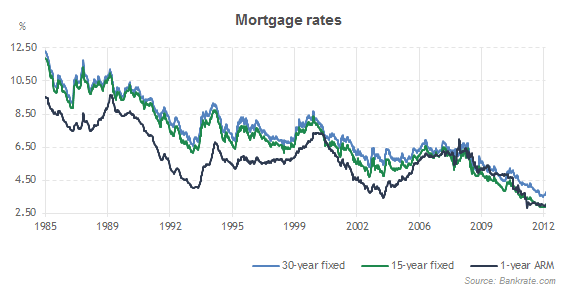

Checking in on refinance mortgage rates, today the average rate for a 30-year fixed refinance saw a decrease, while 15-year fixed Refinance rates advanced. If you’ve been considering a 10-year refinance loan, just know average rates moved up. What we’re seeing today is mortgage rates trending in a mixture of directions. The average 30-year, fixed mortgage rates didn’t move, but the average 15-year fixed mortgage rates grew.

Fixed rates are based upon the national average, but vary from state to state. They possess the same interest rate throughout the duration of the loan. Consumers desire these loans if they plan to remain in their homes for the duration of the loan. For example, the consumer obtains a mortgage when interest rates are at their lowest and then interest rates rise. The consumer does not have to worry about their rates increasing because the interest rate is “fixed”. If the interest rates decrease, the consumer may have the option of refinancing, if the costs of refinancing are less than the overall savings.

Loan Terms

The average interest rate for first-time homebuyers is 2.56% based on 725 being the average credit score for this group. In general, the interest rate on a first-time home mortgage would depend on the credit score of the buyer. For a credit score of 770, the average for repeat buyers, a typical mortgage interest rate would be 2.34%. By comparing with us you could save money on anything ranging from credit cards and loans, to savings accounts, investing and insurance.

Mortgage interest rates are always changing, and there are a lot of factors that can sway your interest rate. While some of them are personal factors you have control over, and some aren't, it's important to know what your interest rate could look like as you start the process of getting a home loan. If youre buying and renovating an existing fixer-upper home, you can also finance the purchase price and eligible renovations into a single rehab loan.

First-time home buyers guide: Key takeaways

Discounted mortgage - the interest rate is usually a set percentage below your lender's standard variable rate during the initial deal, which means it can go up and down. The price of new fixes had already been marching upwards, but really shot up after Kwasi Kwarteng’s disastrous mini-budget on 23 September unleashed chaos in the financial markets. The average new two-year fixed rate home loan surged to 6.65% by 20 October. However, about 6.3m UK mortgages (three-quarters of the total) are fixed-rate home loans. These borrowers are insulated until their deals expire – but for many that will be in the next few weeks or months.

We wanted to find out just how big this impact was on the nation, and what the first-time buyer market looks like. To do this, we have reviewed the most significant reports, research papers, and analyses to provide a comprehensive overview on first-time homebuyer statistics. If you’re looking to buy a property in England or Wales, you’ll notice that they’re either listed as leasehold or freehold. We’re here to explain the terms, and share what they might mean for you as a property owner. The process of buying a house can take months, but knowing what to do and where to get help could make it quicker and easier.

Summary Of Current Mortgage Rates

You may already have saved up some money as a deposit, and the larger the deposit the cheaper the interest rate will be. A home is not just an asset, but also has many costs beyond financing; including regular repairs, homeowner's insurance, and property taxes. USDA loans can help people with low incomes in rural parts of the state qualify for a subsidized low-interest loan. The United States Department of Veterans Affairs is the governing body that establishes the rules for the recipients of the VA loans. They also insure the VA loans and establish the terms of the loans offered to veterans.

Many investors over-extended themselves by purchasing multiple properties when prices were high. If the market turns, the home buyers may owe more than the house is worth. Those who wish to sell cannot fully recoup the costs of the home. Therefore, instead of having equity in the home, consumers owe more than the home is worth. Many individuals, in this instance will negotiate with the bank and “short sell” in order to relieve themselves of the debt.

Savings accounts

This will result in a 95% LTV mortgage, which is the maximum that almost all lenders will accept. Tracker mortgage - the interest rate can go up and down during the initial deal, in line with movements in another financial indicator, normally the Bank of England base rate. You need to find a lender who offers shared ownership mortgages if you want to use this scheme. There are certain schemes designed to help first-time buyers get on the property ladders.

The monthly payments will be higher, but the house will be paid off faster. If you’re hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Keep in mind that lenders generally reserve the lowest interest rates for borrowers with strong credit profiles, including FICO scores in the mid 700s. Before you decide to refinance, be sure to go over the cost of refinancing with the potential savings to see if it makes financial sense. The average rate on a 30-year fixed-rate mortgagehas remained below 3% since July 30, dipping down to an all-time low of 2.88% in early August.

Homebuyers down payment assistance program, along with VA and USDA loans, have no down payment requirements for qualification. Variable rateWhen your initial mortgage rate ends, the interest on your mortgage will be calculated using the HSBC Standard Variable Rate or HSBC Buy to Let Variable rate. If youre a first-time buyer with low to moderate income, HFA loans can make homeownership more accessible and affordable. Also, the buyers and sellers report said 88% of all homebuyers were White as Latino buyers comprised 8%, 3% were Black and 2% were Asian and Pacific Islander.

The government adds a 25% bonus to the money you save, up to £1,000 annually. Shared ownership lets you buy a house with a smaller mortgage and a smaller deposit. The First Homes scheme allows first-time buyers in England to purchase properties for 30 to 50% less than market value. Mojo will find out about your circumstances, check your eligibility, and search across the whole of market to help you secure the best mortgage for your circumstances.

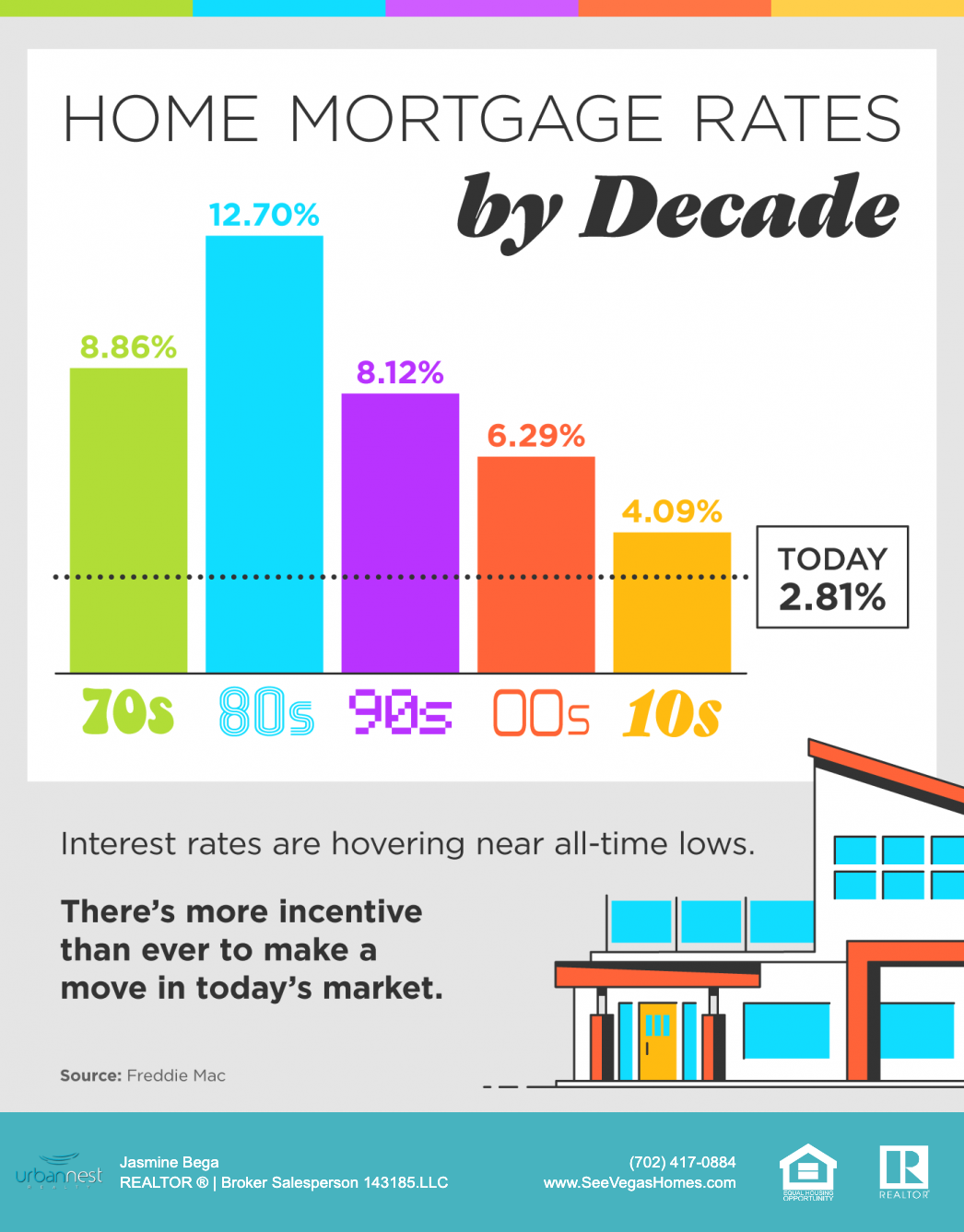

In the first 5 months of this year the average interest rate on a 30 year fixed rate mortgage is 4.32% for American home buyers. According to the data reported by Freddie Mac over the last 20 years, current interest rates are still near historic lows. The highest average interest rate in the last 50 years peaked at 16.63% in 1981. The lowest average annual interest rate on a 30 year conventional mortgage was in 2021 at 2.96%.

What’s considered a good credit score for a mortgage?

Mortgage rates have steadily ticked up since the beginning of March, reaching a 12-year high of 5.11% in mid-April. The first step in the homebuying process is to get a mortgage preapproval. Before joining the Insider team, she was a freelance finance writer for companies like SoFi and The Penny Hoarder, as well as an editor at FluentU. Many or all of the offers on this site are from companies from which Insider receives compensation . Advertising considerations may impact how and where products appear on this site but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

The best time to secure a mortgage or refinance is when the rates are the lowest. Compare the National Mortgage Rate average over the past 10 to 20 years. If the rate is at one of its lowest points historically, then it can be a safe entry point into the market.

No comments:

Post a Comment